Bangladesh has made remarkable progress in improving women’s access from education to healthcare. However, despite these positive indicators, there remains a significant gender disparity in economic outcomes. The recent ‘Economic Participation and Opportunity’ sub index ranks one of the lowest globally (139th out of 147 countries), hindering women’s economic empowerment which is highly correlated to their access to digital finance.

Financial inclusion has the potential to bridge this gap and enable women to participate more actively in the economy. Reports indicate that women who use financial services have greater opportunities to participate in the workforce and assert agency within their households. Access to financial products such as payments, transactions, savings, credit, and insurance can unlock their potential, allowing them to find employment or start their own enterprises. Moreover, increased financial inclusion empowers women to have a stronger voice in household decision-making, contributing to greater gender equality.

However, Bangladesh faces challenges in achieving widespread financial inclusion for women. According to the Global Findex 2021, it is among the top 5 economies with the highest unbanked population since 2017, with only 43% of women having bank accounts. Even more concerning is that 4.3 million women with accounts have not utilized them in the past 12 months. Additionally, while Mobile Financial Services (MFS) hold promise for women’s financial inclusion, currently only 7.2% of women use their own MFS accounts, with 20% accessing services indirectly from Self Financing Schemes (SFS). Despite this, 57.8% of women are still not connected to SFS services, indicating a disconnect that needs to be addressed.

The Potential of the Female Workforce in Digital Financial Inclusion and Its Positive Impact

Bangladesh is the only country among 64 selected economies where women earn more wages per hour than men, according to a United Nations report. The estimation was made considering factor weighted average based on education, age, part-time/full-time work, public/private work, and so on. When considering hourly wages, women in Bangladesh make more than their male counterparts, beating high-income economies such as the USA, UK, Canada, Sweden and the Netherlands. The latest report by the UN shows that the pay gap has been reduced by 5% points, an indication that Bangladesh has made a big improvement in this regard within just a year.

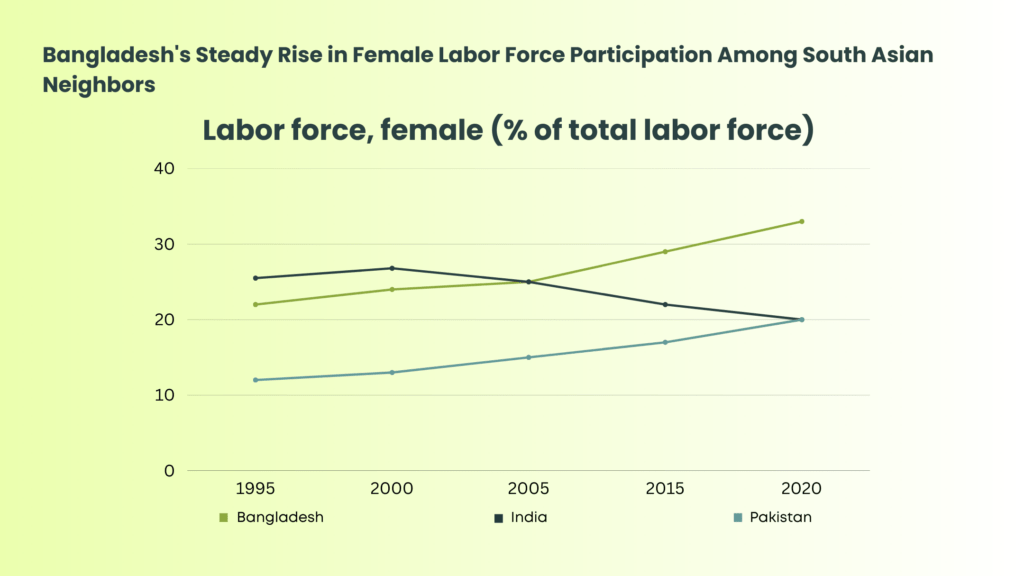

Additionally, Female labor force participation rate in Bangladesh has increased significantly over the past five years, especially in rural areas. Female participation in Bangladesh’s labor force has increased to 42.68% in 2022, up from 36.3% five years ago, according to a survey report conducted by the Bangladesh Bureau of Statistics (BBS) which is also significantly contributing to the country’s declining unemployment rates as well.

Therefore, these two significant indicators indicate that the female workforce can create a massive economic impact only if provided with adequate access to digital finance and promoting financial inclusion among women.

Access to finance empowers women, enhancing their financial independence and economic empowerment. Notably, evidence reveals that when women receive direct wage payments into their accounts, it boosts their financial control, decision-making within households, and savings, while reducing reliance on borrowing. During the COVID-19 pandemic, mobile money account ownership expanded among women in developing nations like Bangladesh. However, challenges such as limited mobile phone access, distance from bank branches, and low financial literacy persist, hindering women’s participation in formal financial systems. Despite short-term gains during the pandemic, ensuring long-term inclusion for women remains a crucial goal.

Bangladesh Government's Data-Driven Approach to Close the Gender Financial Inclusion Gap

Data-driven solutions and product design for especially women, can be supported through the following approaches:

- Establish a national digital payments dashboard with sex-disaggregated data: As digital payment adoption increases, a centralized database ensures accurate data collection, storage, and analysis. This collaborative effort with a nodal agency identifies data sources and reporting agencies, allowing policies and solutions to be gender-inclusive and tailored to women’s needs.

- Conduct consumer perception surveys: These surveys evaluate opportunities and challenges faced by digital payment users and non-users, providing insights into digital payment awareness, adoption, and usage among individuals and enterprises. Prioritizing these challenges helps governments, financial service providers, and regulators address gender-specific barriers.

- Implement a financial technology (fintech) regulatory sandbox: Fintech companies can test new business models, products, and services in a controlled environment without immediate consequences. This fosters collaboration between fintech companies and established financial institutions, streamlining solution development and encouraging innovation to promote financial inclusion, including for women.

Improving access to finance through ‘Sathi Network’

The Sathi Network is an agent network led by women, with the primary objective of accelerating financial inclusion for rural and marginalized women. Their approach involves empowering women’s entrepreneurship, enhancing their financial literacy, and providing access to financial services. Currently, the network comprises over 300 dedicated women agents, committed to increasing financial engagement among unbanked and underserved marginalized women.

To achieve their goals, the Sathi Network has partnered with financial service providers, including banks and mobile financial services. These agents play a pivotal role in offering financial services to marginalized women, leading to significant progress in bank account openings. More than 160,000 marginalized women have already opened accounts through the women agents associated with the Sathi Network.

Beyond merely offering access to financial services, the Sathi Network actively encourages rural women to effectively utilize these services. They do this through yard meetings and organizing various financial and digital literacy campaigns. These initiatives have resulted in over 100,000 marginalized women gaining essential financial knowledge, empowering them to manage their assets independently and make informed financial decisions.

The impact of the Sathi Network’s efforts extends beyond individual empowerment. By empowering women financially, the network aims to strategically invest in catalyzing various aspects of the economy and society. This includes fostering economic growth, reducing poverty, promoting entrepreneurship, creating job opportunities, and enhancing the overall social well-being of women in Bangladesh.

To conclude, the data-driven solutions and initiatives like the Sathi Network in Bangladesh have demonstrated a remarkable impact and hold tremendous potential for closing the gender gap in digital financial inclusion. By providing women with greater access to financial services, these efforts are empowering them with financial independence, decision-making capabilities, and opportunities to participate actively in the workforce and entrepreneurship. The resulting economic empowerment of women not only drives individual progress but also fosters overall economic growth and social development in the country. As Bangladesh continues to prioritize and expand these initiatives, it has the opportunity to set a transformative example for the region, paving the way for greater financial inclusion and gender equality across South Asia.