In Bangladesh, women leading impoverished rural households are dedicating a substantial 30% of their expenditure to safeguard against the impacts of climate change, as revealed by a joint study from the International Centre for Climate Change and Development (ICCCAD) and UNDP. Strikingly, these women, driven by a burning concern for reducing climate-related damage, are often constrained by financial limitations compared to their male counterparts, creating a significant disparity.

Our recent study also indicates that despite the majority of coastal communities being unfamiliar with the term, women exhibit a posiitve inclination to embrace green business practices for their future livelihoods & reduce the impacts of climate change, provided the necessary support. Their positive approach can be the first step to empower coastal women through the adoption of green businesses gain momentum, tapping into emerging funds and financing schemes under the Green Business & Climate Fund.

In this article, we delve into the knowledge and perceptions of women regarding green business, unravel the challenges they confront, and explore potential solutions. By addressing these challenges and empowering coastal women to actively participate in green enterprises, we aim not only to uplift their livelihoods but also to contribute significantly to a more sustainable and resilient future in the face of climate change.

Current Livelihood Scenario

According to our recent study in the coastal area of Bangladesh, the predominant livelihood options included day labor, small business, farming and fishing. About one-fourth of the respondents reported that their female household members were engaged in livelihood activities, mostly in day labor and farming. About a quarter of the respondents were found dependent on natural resources for their livelihoods (fishing and forest resource harvesting) and more than half of them relied on it as their primary means of livelihood. Majority of these resource dependent respondents felt they had adequate access to the ecosystem, although they had to remain inactive for three months on average for resource extraction bans and not all of them had support from relevant government departments. Only 6.3% respondents demonstrated some level of understanding of potential livelihood alternatives and associated market connections, where shrimp farming was regarded as a resilient livelihood by majority due to increasing salinity in the target area. Regarding livelihood improvement, only 8.3% of the respondents received training, mostly on agricultural activities and tailoring, often targeting women.

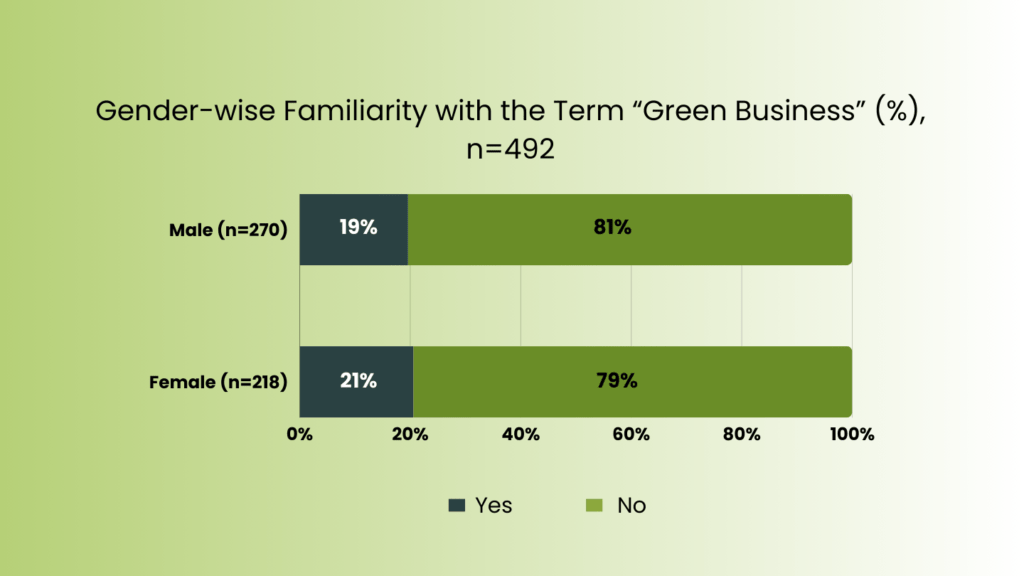

Familiarity with the Term ‘Green Business’

In terms of green business, most respondents were unfamiliar with the term ‘green business’ according to our recent study, but were able to identify some green practices in their areas, which included organic farming, making cottage products etc. About 19.9% of the respondents demonstrated familiarity with the term ‘green business’, while the overwhelming majority (80.1%) were not acquainted with the term. A gender wise look indicates that both males and females exhibited similar levels of familiarity at around one in every five people.

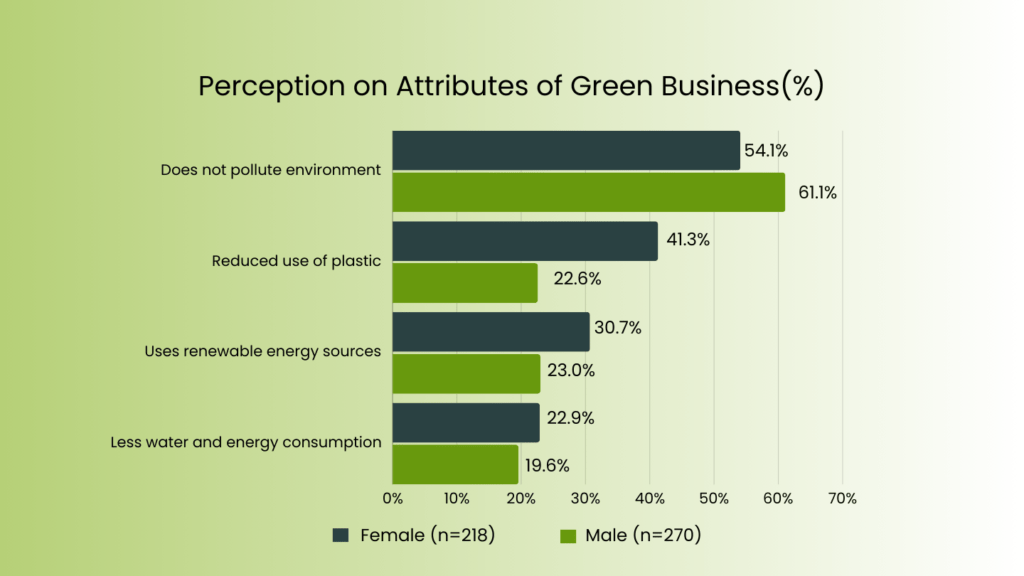

Perception on the Attributes of Green Business

The respondents displayed a moderate level of comprehension regarding the key characteristics of green business. About 65% of the respondents were able to identify at least one key attribute of green business. The most widely recognized trait of green business was its non-polluting nature, acknowledged by 58% respondents, followed by reduced use of plastic (30.9%). It’s worth noting that there were no significant disparities between male and female respondents in their ability to identify these green business attributes. But female respondents showed better understanding than males.

Challenges

Despite women’s interest and perception for green business, they mostly face hurdles in adopting one. The reason could be-

- Lack of people’s comprehension on the value of green products: In Bangladesh, women face challenges in adopting and promoting the value of green products due to limited awareness and education. Many may not fully grasp the environmental or health benefits, making it harder to market these products effectively.

- Lack of relevant documentation: Women often encounter obstacles in obtaining and maintaining necessary documentation for their businesses, that includes – maintaining bookkeeping log, using cash memos and receipts, preparing monthly budgetary plans etc. which hampers their access to resources and support, limiting their ability to grow their ventures.

- Unaccounted wage: Women frequently face issues of unaccounted wages, especially in informal sectors. The engagement of the female family members in a business owned by male members in the same business often went unaccounted for in terms of wage. This lack of formalization hinders their financial stability and opportunities for growth.

- Not accessing formal banking for loans: From our study, Accessing banks for loans was found less desirable due to its complex loan providing procedure.Many women in Bangladesh avoid formal banking due to various reasons such as lack of collateral or financial literacy. This limits their access to loans and financial services critical for business expansion.

- Lack of business hubs to facilitate green business: In the target area, hardly any such hub or platform was observed, however, co-operatives (locally known as ‘Samiti’) were found available, created from both Government and local people initiative. But an unified (online or offline) platform is not present that solely facilitates green business operations and promotes women engagement in such initiatives.

Way Forward

Initiating impactful change in Bangladesh begins with targeted training programs that resonate with the local context. These programs delve into sustainable agriculture, aquaculture, and eco-friendly business practices, drawing inspiration from successful initiatives in neighboring South Asian regions. For instance, in the Philippines, initiatives like the “Green Initiative” have empowered communities through sustainable farming practices. In Sri Lanka, where traditional agricultural practices have seamlessly integrated with modern sustainable methods, there are lessons for Bangladesh to embrace. This approach aims not just at awareness but at fostering a deep understanding rooted in local realities. The objective is to equip women with practical skills for sustainable income generation, complemented by essential financial literacy to navigate the unique challenges of their businesses.

Bangladesh can draw inspiration from successful global models, where partnerships with local stakeholders and NGOs have yielded remarkable results. For example, in Thailand, the “Sufficiency Economy Philosophy” has encouraged local communities to embrace sustainable practices, providing a model for collaborative initiatives. The Bangladesh Women Chamber of Commerce and Industry (BWCCI) could play a pivotal role, taking cues from successful women-led cooperatives in the Philippines. The Samahan ng mga Mang-uukit ng Kawayan (SMK) cooperative, focused on bamboo craft, showcases the potential of women-led cooperatives in driving sustainable businesses. By fostering collaborative hubs, the goal is to create a supportive ecosystem where mentorship, resource-sharing, and collective problem-solving become integral to the success of green businesses.

Tailoring financial instruments to the needs of women entrepreneurs finds precedence in successful initiatives across developing economies globally. In the Maldives, where coastal resilience is crucial, microfinance initiatives have empowered women to lead in eco-friendly ventures. Building on this, specialized loan programs tailored to women entrepreneurs in Bangladesh can take inspiration from successful models in Indonesia, where programs like Kiva have effectively facilitated women’s access to financial resources for green businesses. The emphasis here is not just on providing loans but on empowering Bangladeshi women with the knowledge and tools to navigate financial landscapes, ensuring sustained growth in their green ventures.