Assessing Skill Gaps and Exploring Employment Opportunities in Bangladesh’s Agro-processing Industry: A Sectoral Assessment

Background

Bangladesh faces a pressing challenge as a significant portion of its working-age population, about 65%, remains underutilized due to skill gaps and mismatches. A study by the Bangladesh Institute of Development Studies (BIDS) indicates that nearly 96% of the population lacks the skills required to contribute effectively to the country’s production sector. This issue has resulted in elevated youth unemployment, standing at 10.6%, well above the national average of 4.6%. Moreover, 85% of the employed population finds work in the informal sector, characterized by low income and productivity.

The Agro-Processing (AP) sector, responsible for transforming agricultural, forest, and fisheries products, employs around 250,000 people and contributes 1.7% to the GDP, making up 3.5% of total exports. In 2022, the AP sector marked a significant milestone by surpassing $1 billion in exports and achieving a total sales volume of $2.5 billion. Despite its growth, the AP sector faces substantial skill gaps, a challenge shared with ten other sectors, each dealing with an average skill gap of 30%.

To address these critical issues and foster sustainable economic growth, Swisscontact, in collaboration with the Embassy of the Kingdom of Netherlands, has initiated the “Building Youth Employability Through Skills” (BYETS) project & to assess the feasibility and potential impact of this initiative, Inspira Advisory and Consulting Limited was commissioned to conduct the sectoral assessments for the Agro-Processing and ICT sectors in specific regions. This comprehensive strategy endeavors to overcome employment challenges and pave the way for a more promising future for Bangladesh’s workforce.

Study Approach

The sectoral assessment was conducted to serve the following purposes:

- Identify market-driven skills demanded by employers.

- Assess the capacity of TSPs to offer in-demand courses.

- Identify cluster pockets with capacity to accommodate youth in income generating activities.

- Identifying scopes for income generation with relevant stakeholders

Study Findings

The AP sector is diversified in terms of product, industry size, and market type. The agro-food processing industry has been exclusively selected for further investigation based on the kick-off discussions and consultation with industry associations since, this industry employs a sizable number of people and makes significant contributions to the economy.The agro food processing industry has been divided into four sub sectors to be individually analyzed in the following section.

A. Meat Processing

Employment Scenario in the Meat Processing Sector: The global halal meat processing industry, valued at $802 billion in 2021, is expected to reach $1,657.44 billion by 2030, driven by increased demand for safe and reliable food. With this projected expansion, this sector has the potential of creating significant employment opportunities in the global market. Leading exporters include Brazil, Australia (New Zealand), and India, with Pakistan, Bangladesh, and Egypt also playing key roles.

Halal law mandates that only Muslim men can slaughter animals for their meat to be considered halal, resulting in a demand for Muslim labor in these countries. New Zealand, for instance, faces a persistent shortage of halal butchers, partly due to its small Muslim population. So there is a notable demand for training and certification in advanced butchering skills, especially for those aiming to work in countries like Europe and Australia.

In the domestic market, Bengal Meat is the primary producer in the ruminant meat industry in Bangladesh, employing around 700 workers. Other organizations, like Dutch Dairy & Quality Feeds, are planning to establish meat processing plants, and projects like the “Rural Micro Enterprise Transformation Project (RMTP)” funded by PKSF and IFAD aim to create value chains for high-value agricultural products, including ruminant meat and poultry, resulting in the creation of 2,000-3,000 employment opportunities in the meat processing industry in the next 2-3 years.

Skill requirements and training dynamics: The meat processing industry requires physically fit workers with technical skills but no specific education. Physical fitness is crucial due to the need to work in low-temperature environments (8 to 10 degrees) for meat preservation. Biosecurity is a priority in white meat processing, leading to restricted living conditions for workers to prevent germ spread, resulting in a high turnover rate. Ruminant meat roles favor males, while white meat roles are suitable for females.

Although there is a training module by BTEB for Poultry and Meat Processing at different NTVQF levels, no training programs have been launched. Currently, there are no Training Service Providers (TSPs) offering training in this sector. Bengal Meat provides on-the-job training but only to its recruited employees, leaving a demand for training among overseas applicants unmet.

B. Seafood processing

Employment Scenario in Fish and Shrimp Processing Sector: Due to the temporary or permanent closure of many fish processing companies in Khulna, Satkhira, and Chattogram zones, a stark decline was observed in the current workforce in the fish processing industry. Nearly 50% of the companies faced closure during and after-COVID period which resulted in rapid shrinkage of the labor force.

Skill Requirements and Training Dynamics: Fish processing industry skills encompass technical (machine operation and quality control) and non-technical (manual processing) skills. Machine operators typically require diplomas or experience.Non-technical workers are recruited without prior formal skills, receiving on-the-job training through department supervisors for 5-7 days, acquiring cross-sectional skills.

In the fish processing sector, about 75% of workers are female, mainly engaged in tasks like quality checking, packaging, and labeling in the cold storage department. In Khulna, non-technical workers are often recruited via third-party recruiters, meeting urgent demand for skilled labor.

C. Consumer Packaged Goods (CPG – Food and Beverages)

Employment scenario in consumer-packaged goods: In the CPG (Consumer Packaged Goods) sector, manufacturing processes can be divided into three categories:

- Pre-processing: Involves sourcing and inputting raw ingredients into machines and containers, often employing day laborers on a temporary basis to meet seasonal demand.

- Processing: Encompasses operating various machines like filling, shaping, and ovens. Companies provide brief training to new machine operators, and they may also hire specialized electricians to maintain and repair machinery, usually requiring a diploma.

- Packaging: The final product is packaged in containers or boxes for transportation, often relying on contractual workers, with additional hires based on seasonal demand.

D. Dairy Products

Employment scenario in Dairy Products: In the Dairy Products sector, the workforce is primarily engaged in cleaning, packaging, storing, and related tasks. Some work as lab assistants at milk collection points, responsible for quality testing and milk preparation. Roughly 300 people are employed in these roles, mostly with SSC qualifications. The production line requires technical expertise, often filled by individuals with diplomas.

In the ice cream industry, seasonal recruitment is common, especially in warehouse management during the summer. A leading company with approximately 500 employees includes long-term staff (100-150) and temporary workers (300-350) primarily engaged in ice cream packaging for shipment.

Lab assistants at milk collection points are mainly male, while in factories, males are preferred for machine operations and maintenance, whereas females are typically found in the packaging section.

Demography Of Survey Sample Size

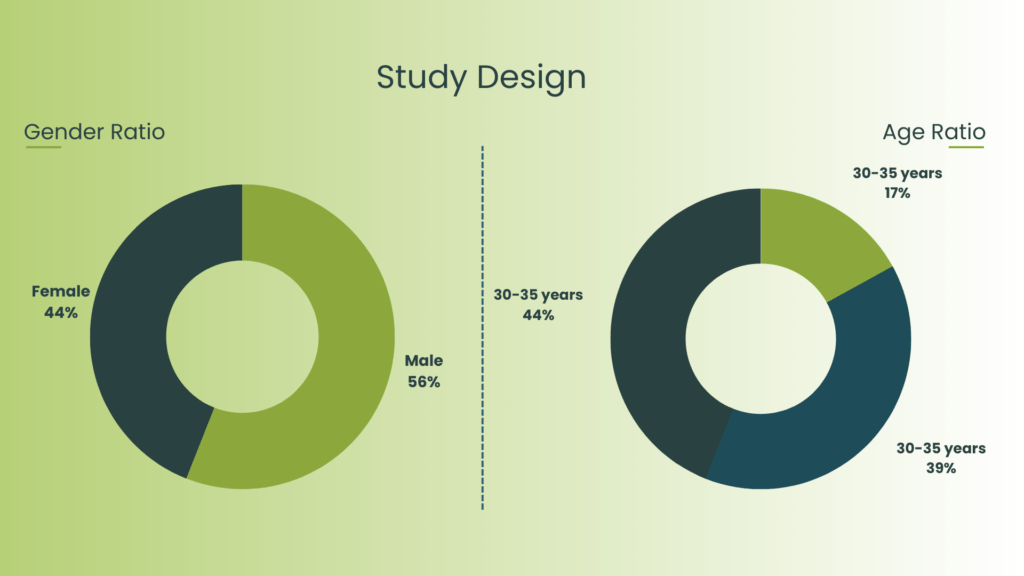

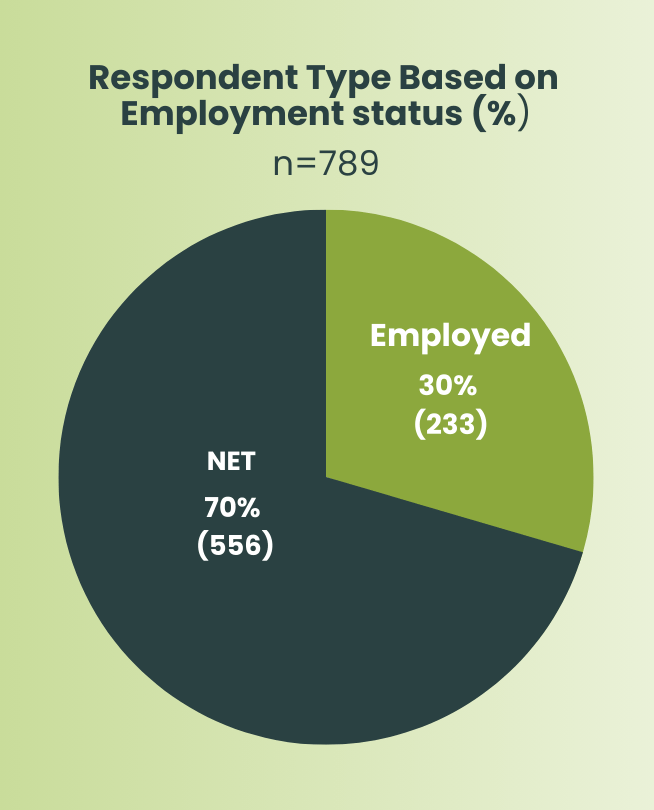

Gender and age distribution

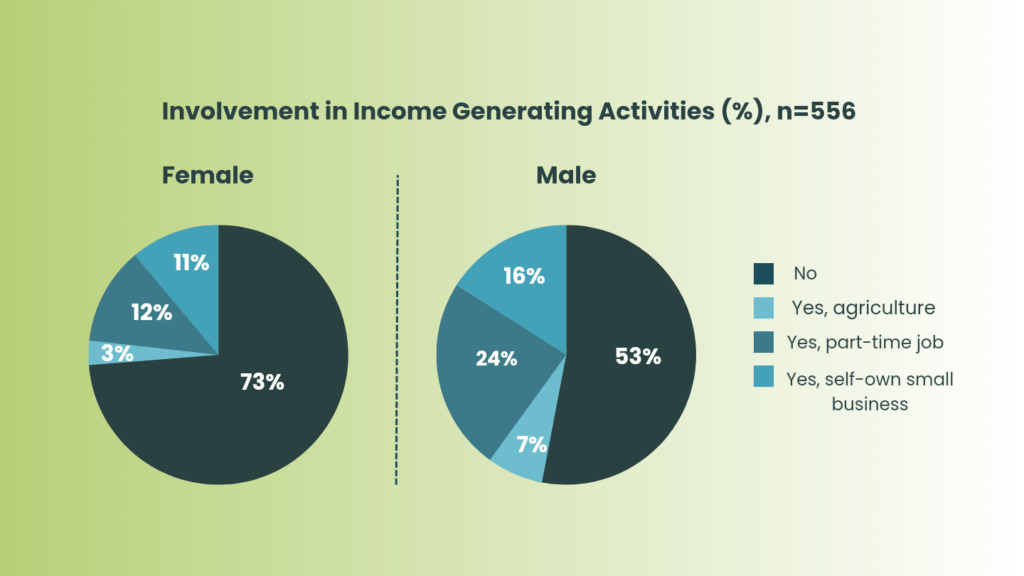

Inspira aimed for a 50% female representation in their survey but faced challenges due to the low participation of employed individuals in the sample (25%) and the relatively low female labor force participation rate (around 36% in 2022 according to Bangladesh Bureau of Statistics). This led to a lower proportion of female respondents, falling short of the desired 50-50 split.

Preferred Occupations by NET (Not in Employment or Training) group

In targeted districts, the agro-processing sector sees significant youth interest in occupations like Food Processing & Quality Control, Food Safety & Hygiene, Food Preparation, and Poultry & Meat Processing. This interest is driven by a lack of knowledge about the sector, with youth choosing occupations based on familiar names related to agro foods. As a result, they may not fully grasp the specific skill requirements associated with these roles.

To boost awareness of the agro-processing sector, training programs should emphasize skill requirements and career prospects in Food Processing, Quality Control, Safety & Hygiene, Food Preparation, and Poultry & Meat Processing among youth. Clear information on earning potential and career paths can further motivate their interest.

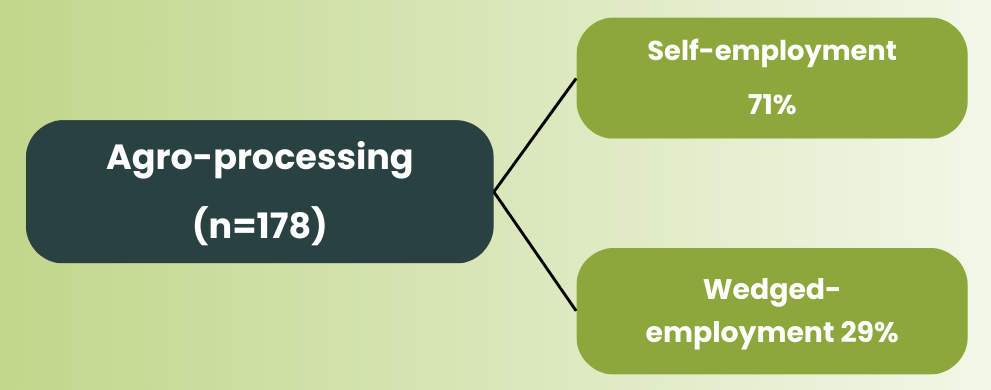

Preferred employment Type: More than two-thirds of agro-processing enthusiasts aim for self-employment, driven by family farming backgrounds. However, opportunities for agro-processing entrepreneurship are limited due to a lack of export knowledge and inadequate training in entrepreneurship skills. To address this, efforts should focus on educating and guiding youth in export industry practices, fostering economic growth in the agro-processing sector.

Willingness To Have Training

In the targeted regions, most youths are interested in training programs, particularly in agro-processing. However, about 75% of them lack access to such training. Institutionalized agro-processing training opportunities are low where TSPs give training in very few selective trades such as Food preparation, Food safety & hygiene etc. While training like HACCP, Lean Six Sigma, Quality Control, Packaging, Machine operation are given by employers themselves through on-the-job training.

In a survey across six districts, over 90% of youths express interest in training, except in Gazipur, where more than a third are not interested. Barriers include the lack of quality training centers in Gazipur and Satkhira, necessitating long travel distances. Key barriers identified by youths include:

- Lack of job placement services at training centers, leading to doubts about the value of certifications.

- Limited availability of reputable training centers in peri-urban areas, prompting a need for residential facilities in urban centers.

- Financial constraints prevent students from investing in training, leading to a demand for subsidized or free training

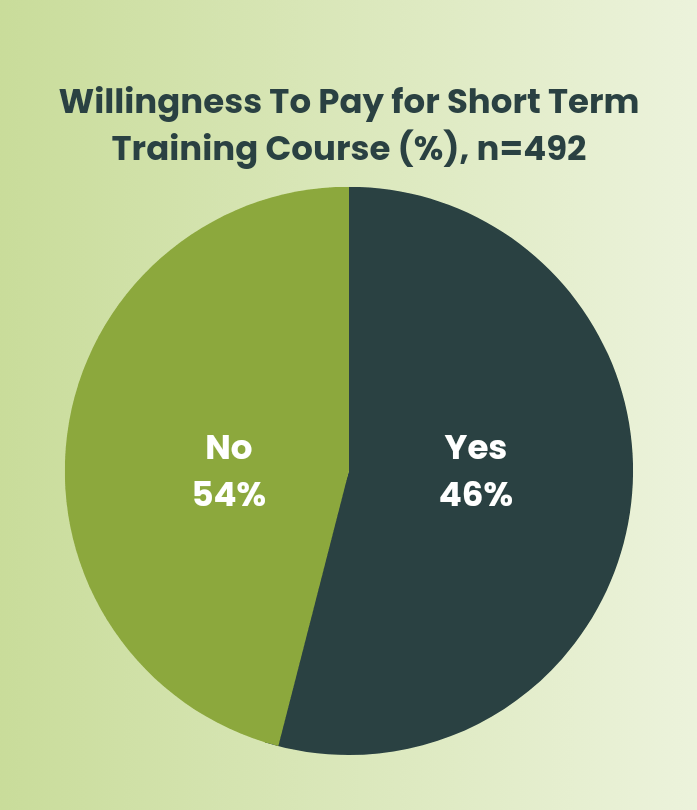

Willingness to Pay

Less than half of the youth respondents who showed interest in the agro processing sector are willing to pay for any training. Potential reasons can be the interested youth usually come from the lower income group from peri urban areas. This group of individuals tends to possess limited knowledge about different career paths, which can lead to a lack of understanding regarding the potential returns on investment. In particular, they may struggle to determine how much to spend on education and training and how much benefit they can expect to receive.

Quality & Usefulness of The Training

Training Modality: Over half of the interested youths in the agro-processing sector prefer a mixed approach to training. However, field observations suggest that online training may not be as effective in this sector, primarily because it is factory-oriented and requires hands-on experience with equipment. Nevertheless, certain aspects like quality checks, food hygiene, and manufacturing protocols can be effectively learned through online training.

Training Quality: Over one-third of employed respondents in the agro-processing industry who received training during their employment reported that their training lacked practical hands-on experience. Focus group discussions revealed that in certain areas like food preparation (cooking, baking, and food preservation), trainees had insufficient facilities for hands-on training. Training predominantly occurred in group settings, with trainers demonstrating techniques, and trainees primarily observing. To improve the quality of training in the agro-processing sector, there is a need for a more individualized approach with a stronger focus on providing practical work opportunities.

Access of Job News

In Dhaka and Khulna, 50%+ of youths access job news easily due to high smartphone and internet use. Gazipur and Chattogram have lower accessibility (1/5), while Jashore, Rajshahi, and Satkhira show >1/3 ease, with Satkhira being surprisingly strong.

In agro-processing, 2/3 employees find jobs through word of mouth, often through references, while just 5% use online portals. Informal methods like miking and leaflets are common due to factory locations away from towns and limited tech proficiency among local recruits.

Skill Supply Side: Training Service Providers (TSP)

Training service providers in Bangladesh are entities providing skill-based training in diverse trades and occupations. These service providers are owned and led by different stakeholders, such as individuals, organizations, government, etc. and can operate in different modalities and formations.In addition to the training centers, there are also trade/sector specific training initiatives arranged by multiple stakeholders for the purposes of trade acceleration, capacity development, technological improvement, product development, etc.

Recommendations

Recommendations for sub-sector & skill sets: Training Opportunities

Sector | Sub-sector | Potential Occupations | Employment Opportunity | Skill Requirement | |

Agro-processing | Dairy-processing | 1. Lab assistant (quality assurance) 2. Worker (Packaging, Labeling) 3. Entrepreneurs | Medium | 1. Parameter Testing, Storage, preservation methods 2. Primary, secondary and tertiary packaging, loading-unloading, Storage 3. Second step processing (Value added product like yogurt, cheese etc) | |

Consumer packaged goods (CPG) | 1. Packaging Workers 2. Processing Workers | High | 1. Primary, secondary and tertiary packaging, loading-unloading, Storage 2. Fruit pulp processing | ||

Sector | Sub-sector | Potential Occupations | Employment Opportunity | Skill Requirement | |

Seafood Processing | 1. Packaging Workers 2. Processing workers | Low | 1. Primary, secondary and tertiary packaging, loading-unloading, Storage 2. Export Standard Processing | ||

Meat-processing | White meat | 1. Halal Slaughterer | Low (Domestic) Medium (Overseas) | Skill set package- Halal Slaughtering Defeathering Evisceration Washing & Chilling Grading | |

Red Meat | Skill set package-Halal Slaughtering Evisceration Splitting saw operation, Primal Breaking | ||||

Dairy Processing and Consumer Packaged Goods (CPG) are the two high priority sectors for intervention.

- The Dairy Processing sector can be a suitable option for providing training. The growth rate in this sector is satisfactory, with Lab-assistant (Semi-skill) and Packaging workers (Unskilled) being the most required job roles for wedged employment. Based on our research, it is recommended targeting Dhaka and Gazipur for wedged employment, as most of the factories are located there. For entrepreneurship development, we suggest focusing on Rajshahi, as Pabna and Sirajganj are key hubs for milk production in that region.

- The Consumer Packaged Goods sector offers favorable training prospects due to satisfactory growth and a consistent demand for Packaging workers. Diversified employers and high recruitment numbers indicate positive employment prospects. Target districts should include Dhaka, Chattogram, Gazipur, and Rajshahi, with a potential focus on Rajshahi due to upcoming employment opportunities in the Barendra Industrial Area, where Pran plans to create 3500 jobs. Training should concentrate on Packaging and Processing workers in these districts.

Meat Processing is the medium priority sector for intervention.

- It is recommended that the training program for meat processing should be launched in Dhaka, with a focus on overseas work opportunities in countries that are top halal meat exporters. For the future demand of 2000 to 3000 people in this sector, it is suggested to launch the training program in urban areas such as Dhaka and Chattogram, where technical equipment availability is crucial.

Seafood Processing is the low priority sector for intervention

- The seafood processing industry is not showing great growth. No potential opportunities were found. While some SMEs within the seafood processing industry did express a need for export-oriented training, the low demand indicates that this is not a viable sector to invest in as most of the processing companies are not operational anymore.

Functional recommendations

- In the Agro-processing sector, low-intensity training, like packaging, using a Work-Based Training (WBT) approach should be prioritized in collaboration with employers for a more practical learning experience. Enterprises can directly absorb trained youths from the program.

- Additionally, there’s entrepreneurship potential in the Agro-processing sector, especially with product diversity and limited high-intensity machinery. Training service providers currently offering cuisine and baking courses can expand their portfolio with specialized training for entrepreneurs.

- For entrepreneurship courses, product preparation, packaging, distribution, should be included and e-commerce-related components like business operations, social media marketing, page moderation, and cyber security should be added to empower entrepreneurs in the growing e-commerce ecosystem.