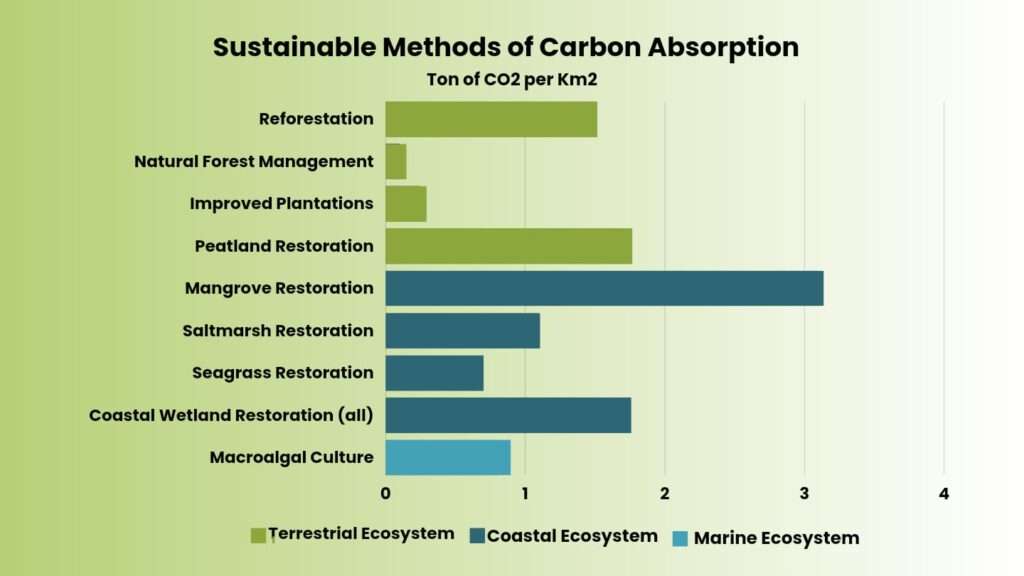

Marine and coastal ecosystems, including seagrass meadows, mangroves, and tidal marshes, act as potent carbon reservoirs, despite covering just 0.2% of the Earth’s surface. These fragile environments are remarkable for their carbon sequestration capacity, storing ten times more carbon in their soils than terrestrial ecosystems. Although they occupy a mere 0.5% of the seafloor, these ecosystems could be responsible for over 50% of all carbon stored in marine sediments.

In this context, ‘blue carbon’ takes center stage. Carbon credits generated through blue carbon projects offer a valuable means for companies to offset their carbon emissions and governments to fulfill their commitments under the Paris Agreement’s Nationally Determined Contributions (NDCs). Nevertheless, despite a growing demand for blue carbon credits and burgeoning interest in such initiatives, these projects still struggle to secure the necessary funding. While funds exist to support climate mitigation efforts, they often face delays in reaching the deserving projects.

Global Blue Carbon Market’s Growing Potential

The significant carbon storage potential has driven increased interest in funding coastal restoration projects through carbon credits. These credits, each representing one ton of carbon dioxide removed from the atmosphere, can be purchased by companies, individuals, and governments to offset their emissions. Blue carbon is now recognized as a vital component of the broader Blue Economy, offering a practical solution to combat climate change.

Currently, registered and planned projects aim to achieve roughly 11 million tons of CO₂ emissions reductions annually once fully implemented, a process that may take several years to a decade. This amount represents only 1% of the potential emissions reductions within this category, underscoring the early stage of the blue carbon market. In 2020, Verra, a leading US-based carbon credit certifier, issued a modest 0.3 million blue carbon credits, a fraction compared to the 32.4 million credits issued in the Agriculture, Forestry, and Other Land Use sector. However, it’s noteworthy that Verra’s issuance of blue carbon credits has steadily grown, tripling from 0.3 million in 2020 to 0.97 million in 2022.

The Emerging Trends of Blue Carbon Credit Price

The recent increase in carbon prices is expected to continue, projected to range from $15 to $24 in 2022 and potentially reaching $40 to $65 by 2040. Blue carbon projects have the potential to secure prices towards the higher end of this range, notably higher than typical prices of $8 to $10 for credits from a standard REDD+ results-based finance approach. Mangrove restoration and afforestation/reforestation efforts can command prices ranging from $15 to $35 per credit, with possible additional premiums due to their positive sustainable development impacts.

Forecasts indicate a sharp rise in blue carbon offset prices in the first half of this decade, driven by high demand from companies pursuing net-zero goals and carbon neutrality, along with limited supply. However, in the second half of the decade, price increases are expected to slow down. Beyond 2030, it’s anticipated that blue carbon offset prices will stabilize as more supply enters the market.

Blue Carbon Projects Around the Globe

In Pakistan, there’s just one extremely large-scale project covering 224,000 hectares, while there are eight moderately to highly scaled projects (over 10,000 hectares) in other locations. In contrast, there are ten smaller projects, each encompassing around 1,000 hectares or less. This indicates a preference for smaller projects in terms of numbers. Few notable projects are-

- Mikoko Pamoja in Kenya, the world’s first mangrove avoided deforestation and restoration project covering 117 ha, achieved validation under Plan Vivo and began issuing credits in 2014. It resulted from a collaborative effort involving the local community, an international university, and a Kenyan Government Research Institute. Mikoko Pamoja’s unique success and enduring presence are attributed to its non-profit orientation, strong emphasis on local ownership, and the establishment of deep, trust-based, and long-lasting community relationships.

- Another significant blue carbon project is happening in Cispatá Bay, Colombia. Here, local communities, regional authorities, research organizations, local and international non-profit groups are teaming up to safeguard and recover 11,000 hectares of mangroves. Their goal is to capture around 1 million tons of CO2 from the atmosphere over 30 years. Additionally, this project is expected to bring various benefits like protecting wildlife, improving water systems, and enhancing the lives and culture of the local people.

- Perhaps the most ambitious and largest blue carbon project on the horizon is the conservation and planting of >325,000 ha of tidal wetlands in the Indus Delta, Pakistan. It is nearly 25 times bigger than Cispatá.

- Another mangrove restoration project in Mexico’s Sinaloa state could sequester up to 3 million tons of carbon emissions each year. The project is developed and implemented by ALLCOT, a global enterprise that focuses on climate change and sustainability solutions.

However, the number of validated blue carbon projects is expected to more than double in the near future. Several projects are planned in Indonesia, Tanzania, Mexico, Honduras and Japan. The majority of future projects will focus on mangroves, though at least 4 projects proposed or under development focus on seagrasses.

Financial Institutions’ Role in Boosting Blue Carbon Projects

Blue carbon projects are in high demand, attracting major buyers who are willing to commit to forward carbon credit agreements and offer incentives such as premium prices and upfront payments. Financial institutions (FIs) can play a pivotal role in this market by:

- Supporting blue carbon project developers with firm carbon purchase agreements, especially when the requested carbon credit prices exceed what major buyers are willing to pay or when the project is in its early stages. FIs can act as primary buyers, offering premium prices, and providing partial upfront funding to facilitate the development of expensive tidal ecosystem restoration initiatives.

- Encouraging the incorporation of nature-based solutions into coastal infrastructure projects they finance. While the blue carbon component of these investments may be limited in scale, FIs can suggest bundling these initiatives into carbon programs.

Furthermore, FIs can contribute to the growth of the blue carbon market by:

- Providing financial assistance and advisory services to insurers in emerging markets to create insurance policies tailored to wetland enhancement projects.

- Designing “blue” bond products focused on coastal wetland conservation and restoration efforts and establishing practical metrics and impact assessment frameworks to assess the use of the bond proceeds.

References

- Deep Blue: Opportunities for Blue Carbon Finance in Coastal Ecosystems- IFC

- GLOBAL SEAWEED NEW AND EMERGING MARKETS REPORT- World Bank

- Blue carbon: the hidden CO2 sink that pioneers say could save the planet- The Guardian

- Capitalizing on the global financial interest in blue carbon